Best Digital

Marketing

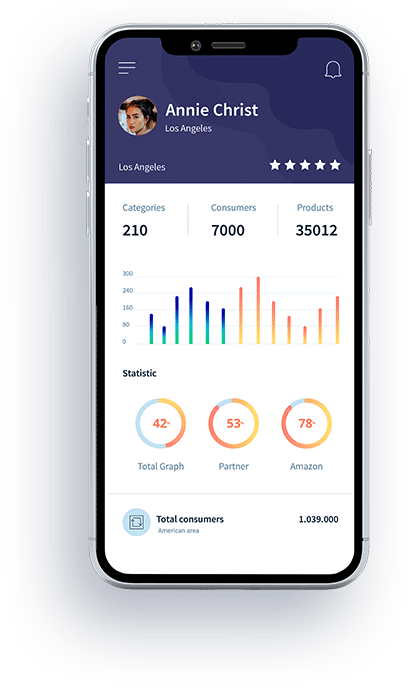

We are the best digital marketing agency. As an online marketing agency, we know how to optimize your website for maximum visibility and conversion rates. Whether you’re looking to increase site traffic or boost brand awareness, our team of experienced SEO experts internet professionals will help get your business where it needs to be.

Best SEO Expert In Bangladesh

Boosts Your Website Traffic!

We are passionate about our work. Our designers stay ahead of the curve to provide engaging and user-friendly website designs to make your business stand out. Our developers are committed to maintaining the highest web standards so that your site will withstand the test of time. We care about your business, which is why we work with you.

Best Social Media Marketing Experts In Bangladesh

Pay for Qualified Traffic

At Freelancer Tamal, we understand the challenges that smaller businesses face when trying to grow their business. That’s why we focus our marketing efforts on helping startups and small businesses achieve success online. We offer a range of services that are tailored specifically for these types of companies, including lead generation, SEO expertise and website design & development.

Digital global audience reach

Content pieces produced everyday

Of the audience is under 34 years old

Employee

worldwide

Why Choose Us

We Offer Best Marketing Services

Get Free SEO Analysis?

Want to see how we can help your business reach its marketing goals? Simply fill out the form below and our team will promptly send you a free analysis of your current website ranking, key content areas and needs.

Blog

Latest News

10 Must-Follow Brand Strategy Companies

Expert Content Creation Services for Digital Success

25 Creative Small Business Advertising Ideas

10 Must-Have Services Offered by Top SEO SEM Agencies

Testimonials

What Our Clients Say

Freelancer Tamal stays ahead of the curve with digital marketing trends.

Design is a way of life, a point of view. It involves the whole complex of visual commun ications: talen.t, creative ability manual skill.

Design is a way of life, a point of view. It involves the whole complex of visual commun ications: talent, creative ability and technical knowledge.

Design is a way of life, a point of view. It involves the whole complex of visual commun ications: talent, creative ability and technical knowledge.